This article is aiming to provide a general overview of all important and relevant conditions that are essential for starting any business activities in Bulgaria. During the past few years Bulgaria has established as one of the best locations for setting up business in Europe. Low taxes, highly qualified specialists, stable macroeconomic framework and the high quality of internet are some of the underlying reasons making Bulgaria an attractive and preferred place for foreign investments and outsourcing activities.

TAXES

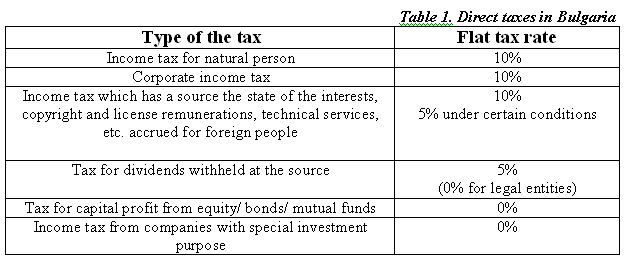

Flat income tax rate and the social and health insurance are the lowest in Europe and one of the lowest worldwide. The amounts of the flat income rates are described in details in table 1 below.

Corporate tax

Corporate flat tax rate is 10%.

Since 2013 payments in advance for corporate tax have been made on the basis of a prognoses of the tax income for the current year. The obligation for payments in advance are for all companies with net income from purchase for the previous year above the amount of 300 000, 00 (three hundred thousands) BGN.

Tax withheld at source

Tax withheld at source is paid for incomes from dividends and liquidation shares, distributed to foreign legal people who are not resident for tax purposes in a Member State or of another state that is part of the Agreement with the EU. The rate of the tax is 5 %. Tax exempted is the dividends which are paid to legal entities that are obliged to pay tax in a Member State of the EU.

Other income from a source in the country – the interest incomes, rents, royalties, fees for technical services, incomes from franchise and factoring, incomes from management and control, incomes from agriculture and incomes from forestry, hunting and fishing economy on the territory of Bulgaria.

Transfer of tax loss

According to tax legislation there is a possibility the realized tax loss to be transferred successively until all of it over the next 5 years.

Value added tax (VAT)

VAT rate is 20% for taxable supplies (except those specified for zero rate), the importation and inter- EU acquisitions. There is also a reduced rate of 9% for accommodation provided in hotels and similar establishments, including provision of holiday accommodation.

Income tax on natural people

The amount of tax over the personal income amounts to 10% (flat tax).

Tax on real estate

The rates for this tax are defined in the Law on local taxes and fees, where they may vary between 0.01% – 0.45% depending on the particular municipality. The tax is assessed on the tax value of the property as at 1st January of the year, which is due and has to be communicated to the persons by 1st March of the same year.

Apart from the tax, a fee for municipal waste is due, which is determined at an annual rate of every location with a decision of the Municipal Council. The fee usually exceeds many times the amount of the tax.

SOCIAL AND HEALTH INSURANCE

In Bulgaria the social security system consists of state social security and additional social security.

Amounts of the insurance burden

Total insurance burden for 2015 is 30.3%. It is divided between the employer and the employee at the rate of 60:40.

That rate of social security burden is valid for the most popular category of labor – third. Higher insurance contributions are applicable to the first and second category of labor. A maximum amount for which social and health insurance contributions are due is introduced – for 2015 it is 2 600 BGN.

LEGAL FORM REQUIRED FOR DOING BUSINESS

For doing business in Bulgaria a legal entity has to be established. Companies regulated by the Commerce Act are the following:

• General partnership;

• Limited partnership;

• Limited Liability Company (OOD);

• Joint Stock Company (AD);

• Partnership limited by shares;

For the establishment of the latter three types of companies there is an obligation for the amount of the capital to be imported and therefore they are called capital companies. The minimum amount of capital that can be imported in the newly formed limited liability company in order to be established is 2 leva, for joint stock companies and for limited partnership with shares – 50 000 leva.

Each company must be registered in the Registry Agency to the Commercial Register, which is public. The legal deadline for registration of the company is up to 5 days after the adoption of all required and properly prepared documents and payment of the relevant state fees.

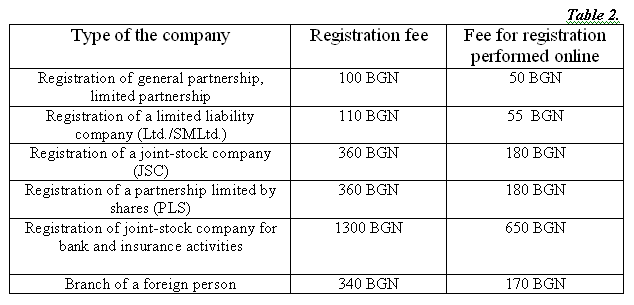

State fees required for the registration of a company

The compulsory state fees are described in Table 2 below.

Lawyers’ fees

Size of lawyers’ fees varies widely. They are subject to negotiation between the client and the Law Company or lawyer. The amounts vary between approx. 400 BGN for the registration limited liability company to 3500 BGN for registration of holdings and consortia.

Remuneration for accounting services and payroll services

The monthly fee for accounting and payroll services of specialized accounting company varies widely and is subject to negotiation. Amounts vary between 120 BGN for unregistered VAT company without staff/employees to more than 5000 BGN for companies with complex production activities and over 200 employees.

Labor costs

Labor costs vary depending on the position and the company. The minimum remuneration is 360 BGN and the average salary in statistics for 2014 is 862 BGN.

Bulgaria offers qualified specialists with English, French, German and other languages. Our IT experts are among the best in the world. In our country there are many companies that outsource business or offer outsourcing-services for the global market. They could attract qualified specialists.

COMMUNICATIONS

Bulgaria ranks first in the world for the fastest and cheapest internet access for the population.

Several mobile operators are offering competitive prices.

New roads and highways are intensively built.

There is a constant growing of the number of services that are performed electronically.

––––––––––––––––––––––––––––––––––-

The article was created by the team of Accounting Company „Debal“ LTD. The company offers high level accounting, tax, payroll, administrative and legal services. We work in close partnership with HR consultants, as well with consultants for management and real estate issues. We can render assistance in registration of a new company, office rent, use of address registration or correspondence with the state administration, hiring manager or procurator of the newly registered companies.

Copyright 2015: Accounting Company Debal LTD. All rights reserved. For more information or advice please contact us by phone +359 02 915 6933 or send us an e-mail: [email protected]. The data in this material has been collected and analyzed by a team of Accounting Company Debal Ltd. and its purpose is entirely informative. We have done everything possible to provide accurate information. Accounting company Debal Ltd. is not responsible for any loss or damage caused or a result of decisions made based on the information provided in this article.

© Accounting Company Debal EOOD 2015.

Hello, i am interested in fuindong an Ltd (ood) company in Bulgaria. The company will be in internet service field (advertisment), so i won’t have any employees. Me and my partner will be the directors of the company. Is it legal to pay no insurance (pension health care), and if it isnt how much will it cost?Our residence will not be in Bulgaria.Thank you

Hello,

Yes, shareholders in companies do not owe social insurance contributions for managing the company if they are not residents of Bulgaria. You have to issue certificates for residenship in your country and present it to the accountant in Bulgaria.

You can also read our article for Social security contributions of a company manager who is a foreign individual: http://debal.net/social-security-contributions/?lang=en